Risk Advisory Building a fit for purpose framework

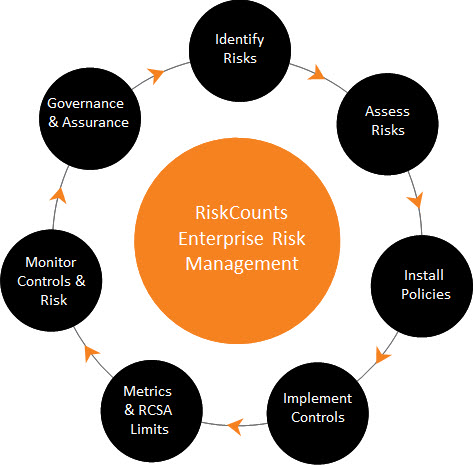

ERM Program Design & Implementation:

- Risks: Identify, define, and assess Inherent Risks including Strategic, Credit, Market, and Operational Risk

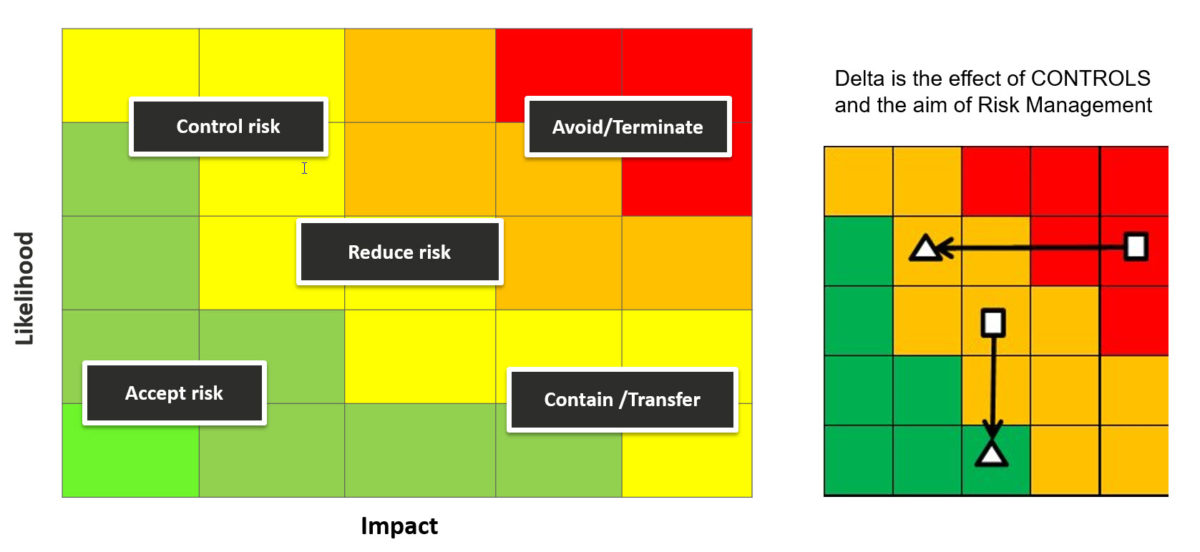

- Gap Analysis and Maturity Assessment: Conduct gap analysis and maturity-assessment against status quo in risks, controls, policies, processes, LOD functionality, and governance

- Risk Architecture: Establish/review required Policies and Procedures

- Lines of Defense (LOD): Recommend appropriate 3 LOD model for the client, considering all its risks and gaps in status quo

- Governance framework: Define a governance framework including required committees and authorities, with

– Limits : for transactional Market & Credit risks

– Metrics (KPI, KRI & KCI) : for Strategic and Operational risks

– Reviews (Risk-Control Self-Assessment)

– What-ifs - Compliance: Cross-check for Legal & Regulatory needs and standards, and Board, Audit, Investor and Client expectations

- Reporting: Outline a methodology with draft set of action-oriented reports and dashboards

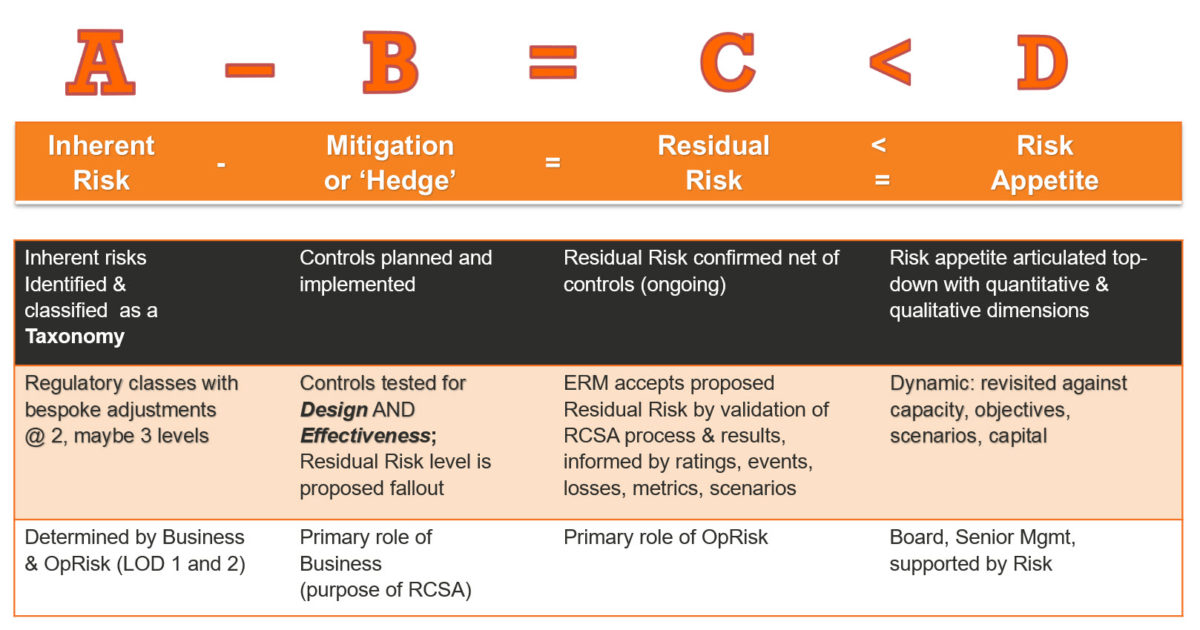

RCSA Advisory Controls testing and Issue Management

Key Focus areas of RCSA Advisory Services:

- RCSA Program: Help establish a comprehensive RCSA program

- Offer a Custom Toolkit: Application offered by RiskCounts is described in “Solutions”

- Training: Train the business functions or the 1st line of defense, and Risk/Compliance or the 2nd line of Defense, in testing control-effectiveness and setting up appropriate control procedures

- Roll-Up of RCSA Results: Assist in roll-up of RCSA output to inform key stakeholders (including Business Managers and Risk Management), of the status of controls as well as key issues

- Issue Remediation : Advise in the collection and consolidation of all RCSA remediation actions, issue management and prioritization; as required help create appropriate project plans