Implementing any platform such as that of RiskCounts is never purely a technology endeavor. There are many other issues, and opportunities, including changing business structure, complex user requirements, supporting multiple stakeholders (internal and external) with differing reporting needs, program governance and SLAs. Having said that, our focus is to examine some of the key technical aspects in building such a platform, and solutions to reside on it.

The need of the day is a simple, elegant, functional and easy to use Risk Applications that can serve business needs.

OUR VISION IN CREATING A PLATFORM

The last 10 years have witnessed an incredible amount of changes in the global financial services. Banks, Insurers & Fintech firms continue to evolve their operating models rapidly in response to a range of forces – regulatory, economic, risk, digital transformation, cyber security, vendor relationships, external threats, technology implementation challenges and employee conduct. All of these present huge challenges on the Operational Risk (OR) front in particular. Indeed, Operational Risk has emerged as one of the highest areas of spend at large institutions. Medium and Small institutions have only now begun investing in this critical area.

From a deployment standpoint, many existing Risk Platforms continue to be seen as inflexible, purely IT-led and complex or cumbersome to use. They are also based heavily on older, bordering on obsolete technology and have notably led to very long implementation and maintenance cycles. As Forrester notes,

“Innovation in the GRC space is still lacking as vendors have continued to leave user expectations unfulfilled. Users also note that while the capabilities of the platform may be extensive and highly configurable, their processes and level of maturity lead them to ignore those advanced aspects of the platform, leaving them struggling to get value out of even the basic functionality they’ve deployed.” **

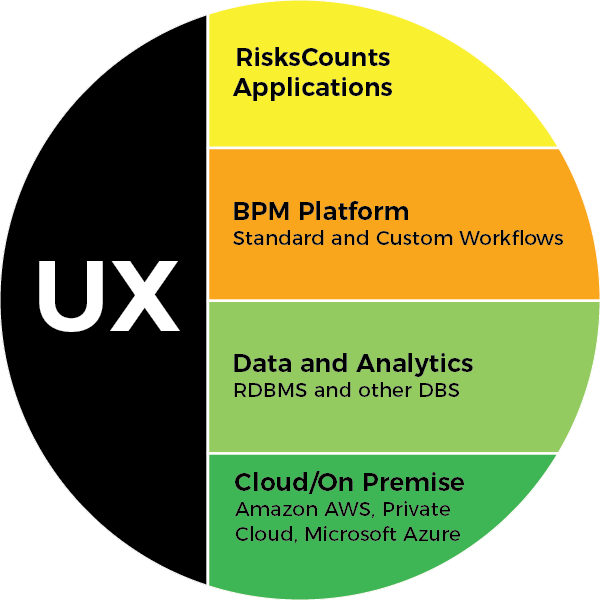

RiskCounts Technology Platform

RiskCounts technology stack provides for a Cloud based deployment model, integrated workflow for different business users, a highly intuitive UX, and proactive monitoring that will meet or exceed user expectations. Key technology elements will include the below:

-

Cloud- The ability to offer our client a rapid turnaround and a superior user experience depends on the ability to use Software Defined Infrastructure predicated on Cloud Computing. RiskCounts applications are typically offered as SaaS products with the lifecycle of resources (request, approval, provisioning,orchestration & billing) as well as the applications deployed on them abstracted away from our customers. The Platform works on an efficient “launch the user interface and use” which results in a fast ROI. The core business logic runs in Docker containers and is orchestrated by a Kubernetes layer which provides full scale up and scale down capabilities based on the user load.

Cloud- The ability to offer our client a rapid turnaround and a superior user experience depends on the ability to use Software Defined Infrastructure predicated on Cloud Computing. RiskCounts applications are typically offered as SaaS products with the lifecycle of resources (request, approval, provisioning,orchestration & billing) as well as the applications deployed on them abstracted away from our customers. The Platform works on an efficient “launch the user interface and use” which results in a fast ROI. The core business logic runs in Docker containers and is orchestrated by a Kubernetes layer which provides full scale up and scale down capabilities based on the user load.

-

Visualization – It is important to enable Risk managers and organizational leadership a view of risk information in near-real-time from various sources – both internal and external. RiskCounts will provide best in class visualization capability based on users and their roles.

Visualization – It is important to enable Risk managers and organizational leadership a view of risk information in near-real-time from various sources – both internal and external. RiskCounts will provide best in class visualization capability based on users and their roles.

-

Ease of Use – RiskCounts provides a highly intuitive User Interface (UX), that is easy to use. the UX provides simple dashboards with complete workflow and rules based access to screens.

Ease of Use – RiskCounts provides a highly intuitive User Interface (UX), that is easy to use. the UX provides simple dashboards with complete workflow and rules based access to screens.

-

Business Process Management – The RiskCounts Platform heavily leverages BPM technology to provide ability to work with different user levels concurrently, while maintaining a current snapshot of the state of the system. All core workflows are designed using a graphical editor that the business can easily use to express their custom process flows.All of the process engine interactions are captured in a BPMN 2.0 compliant notation and can be easily exported to a knowledge management system (KMS) or vice versa.

Business Process Management – The RiskCounts Platform heavily leverages BPM technology to provide ability to work with different user levels concurrently, while maintaining a current snapshot of the state of the system. All core workflows are designed using a graphical editor that the business can easily use to express their custom process flows.All of the process engine interactions are captured in a BPMN 2.0 compliant notation and can be easily exported to a knowledge management system (KMS) or vice versa.

-

Data Analytics - In the field of Operational Risk, it has become critical to be able to embed advanced analytics across the risk tracking life-cycle. This helps not only in managing the well understood risks better but also in detecting new ones as they arise.The RiskCounts team is working on a variety of algorithmic approaches to leverage Data Science to perform this critical function.

Data Analytics - In the field of Operational Risk, it has become critical to be able to embed advanced analytics across the risk tracking life-cycle. This helps not only in managing the well understood risks better but also in detecting new ones as they arise.The RiskCounts team is working on a variety of algorithmic approaches to leverage Data Science to perform this critical function.

-

Uniqueness of this platform – RiskCounts' platform is business focused, with complete workflow management and analytics infused across key areas of the products. The product is available in the cloud or on premises, with easy configuration. Platform can be up and running in less than two weeks and boasts native AI/ ML functionality, that differentiates the product from competition

Uniqueness of this platform – RiskCounts' platform is business focused, with complete workflow management and analytics infused across key areas of the products. The product is available in the cloud or on premises, with easy configuration. Platform can be up and running in less than two weeks and boasts native AI/ ML functionality, that differentiates the product from competition

OFFERINGS OF THE PLATFORM

Enterprise Risk Management/ Operational Risk Management

RCSA

Issue Management & Remediation