Vendor Risk Management Application (Coming)

Banks, financial services institutions and fintech often depend on a large number of vendors and service-providers to fulfill their business processes and satisfy their end-to-end operating requirements. Single sourcing puts institutions at risk by making them too dependent on one vendor. On the other hand, multiple sourcing dilutes vendor accountability, and makes vendor collaboration and coordination much more challenging.

In both sourcing models, vendor risks are high, and should be managed and mitigated through a robust Third Party Risk Management (TPRM) or Vendor Risk Management (VRM) approach.

Key Features

-

RiskCounts has a comprehensive approach and a Risk assessment / ratings model, that can rate a vendor using Macro Variables, Financials and Operational risk inputs

RiskCounts has a comprehensive approach and a Risk assessment / ratings model, that can rate a vendor using Macro Variables, Financials and Operational risk inputs -

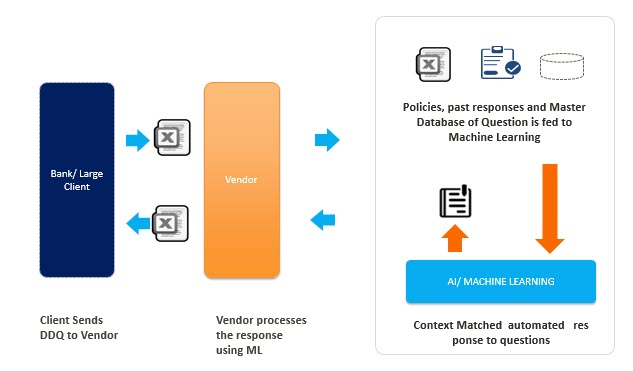

When vendors receive due diligence questionnaires from large banks or large companies (Banks/ Manufacturing firms), responding to questionnaires is tedious, time-consuming with no standardization of responses or database

When vendors receive due diligence questionnaires from large banks or large companies (Banks/ Manufacturing firms), responding to questionnaires is tedious, time-consuming with no standardization of responses or database -

It takes businesses 3-4 weeks & several people to respond. There is risk of inconsistent or incomplete responses

It takes businesses 3-4 weeks & several people to respond. There is risk of inconsistent or incomplete responses -

Our solution automates responding to due diligence, based on policies, procedures, past responses and internal answer databases

Our solution automates responding to due diligence, based on policies, procedures, past responses and internal answer databases -

Solution is driven off a knowledge base using AI/ ML. Semantic learning equips context mapping and pre-populated responses

Solution is driven off a knowledge base using AI/ ML. Semantic learning equips context mapping and pre-populated responses -

Completed responses returned very quickly & in any format The Large Company/ Bank reaps the benefit by automated risk assessment and near real time risk monitoring of the entire portfolio of vendors

Completed responses returned very quickly & in any format The Large Company/ Bank reaps the benefit by automated risk assessment and near real time risk monitoring of the entire portfolio of vendors

Reasons Financial Institutions are Collaborating with Vendors

-

Performance boosting, efficiency

Performance boosting, efficiency -

Cost reduction, comparative costs

Cost reduction, comparative costs -

Access to specific expertise, specialization

Access to specific expertise, specialization

Some of the areas where institutions are outsourcing their processes to third party vendors are:

-

Customer facing activities

Customer facing activities -

General Operations

General Operations -

Regulatory compliance activities

Regulatory compliance activities -

Risk and knowledge process management

Risk and knowledge process management

Types of Vendor Risks

Although hiring a third-party vendor makes processes simpler and more cost-effective, it also brings in multiple risks such as customer service, fiduciary risk, breach of confidentiality, breach of contract, data errors, fraud, and loss of data – all of which have the potential to lead to financial and reputational loss. Such vendor associated risks are often unique, relationship-dependent, and significantly vary based on the type of vendor chosen, as well as the process or service outsourced.

Strategic risk

Reputation risk

Industry risk

Geographical risks

Regulatory & Compliance risks

Operational risks

Transaction risks

Credit risks

4th party risks