Stress Test and Scenario Analysis

Effective stress testing and scenario analysis in the “What-If” sense have become critical elements of the risk management process in the wake of geopolitical and macro-economic uncertainties and crises across the spectrum of credit, market, and operational risk. Such analysis can be purely qualitative or, at the other end, strongly quantitative. A hybrid approach may often make the most sense, resulting in scenarios and consequent stress analysis, across likelihood and impact axes, for senior management consideration and decision-making.

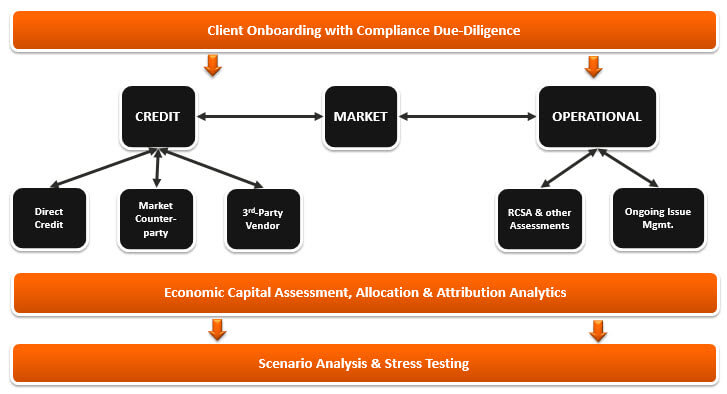

RiskCounts has created an exhaustive list of financial market risk factors and their sub-components. Fundamental risks are categorized by the nature of their origin and frequency of occurrence as Transactional Risk, and Operational/episodic Risk, developed as a “RiskCounts Functional Taxonomy of Risk Factors” and a RiskCounts “Glossary of Risk”. Each fundamental risk category is sub-divided into the more familiar generic risks: Market, Credit, Liquidity, Operational, etc. Analysis may include calculation of periodic rolling returns, variance of returns for a range of scenarios (e.g., business-as-usual to historical worst case) and the maximum draw-downs for a number of actual historical stress events (e.g., Black Monday, 9/11 and the Lehman crisis).

The Rationale for a “Top Down” approach includes:

Challenges in defining sensitivities and scenarios around non-market factors, (e.g., Operational Risk and Strategic Risk) mean that traditional stress-testing focuses only on those factors that are easy to stress in isolation. RiskCounts looks for a holistic approach than simply stress at the level of each discrete factor.

The effort needs to speak to senior management decision-support instead of being purely technical and confined to a corner of risk management analytics, i.e. overall portfolio level and including political and economic factors.

Related to the above, that Scenario Analysis & Stress-Testing be not of academic and intellectual relevance alone; and aim at not just solvency in the extreme case, but also profitability, liquidity and capital adequacy from BAU-to-extreme case.

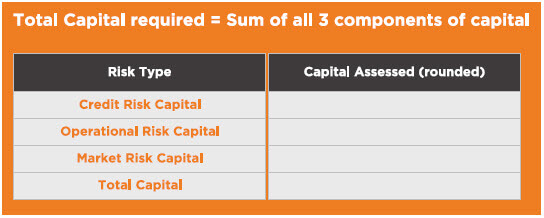

Impact of Stress on capital planning

Step I – Define the firm’s business model

-

Identify business lines

Identify business lines -

Develop a model for each business line identifying key performance metrics and algorithms to account for key variables that drive financial performance

Develop a model for each business line identifying key performance metrics and algorithms to account for key variables that drive financial performance

Step II – Identify Key Risk Factors and Stress Test Scenarios

-

Geopolitical Risks

Geopolitical Risks -

Macroeconomic Factors - translated to bank-specific factors using appropriate algorithms

Macroeconomic Factors - translated to bank-specific factors using appropriate algorithms -

Firm Specific Risk Factors –follows fundamental classifications defined in RiskCounts Glossary of Risk

Firm Specific Risk Factors –follows fundamental classifications defined in RiskCounts Glossary of Risk

Step III – Identify Stress Test Scenarios

-

Dimension Scenarios

Dimension Scenarios

Step IV – Model Input and Output

-

Firm-specific data inputs

Firm-specific data inputs -

Reports and dashboards for management interpretation and decisions

Reports and dashboards for management interpretation and decisions