Counterparty Credit Risk Application

The RiskCounts’ Counterparty Credit Risk application provides complete and standalone capability to :

- manage a full credit life-cycle

- rate counterparties – publicly listed or private unlisted names

- assign internal credit and settlement limits

- create and manage watch-lists, portfolio views, dashboards for exposures, and,

- manage complete workflow-based approval and monitoring processes for limits submissions, designations & approvals and review/cancellation

The application integrates with feeds from a major rating agency for Macro and Financial data-points which are used as inputs in the ratings calculations

The application is particularly useful for small to medium organizations that are engaged in the business of lending, payments, foreign exchange transactions, or trading.

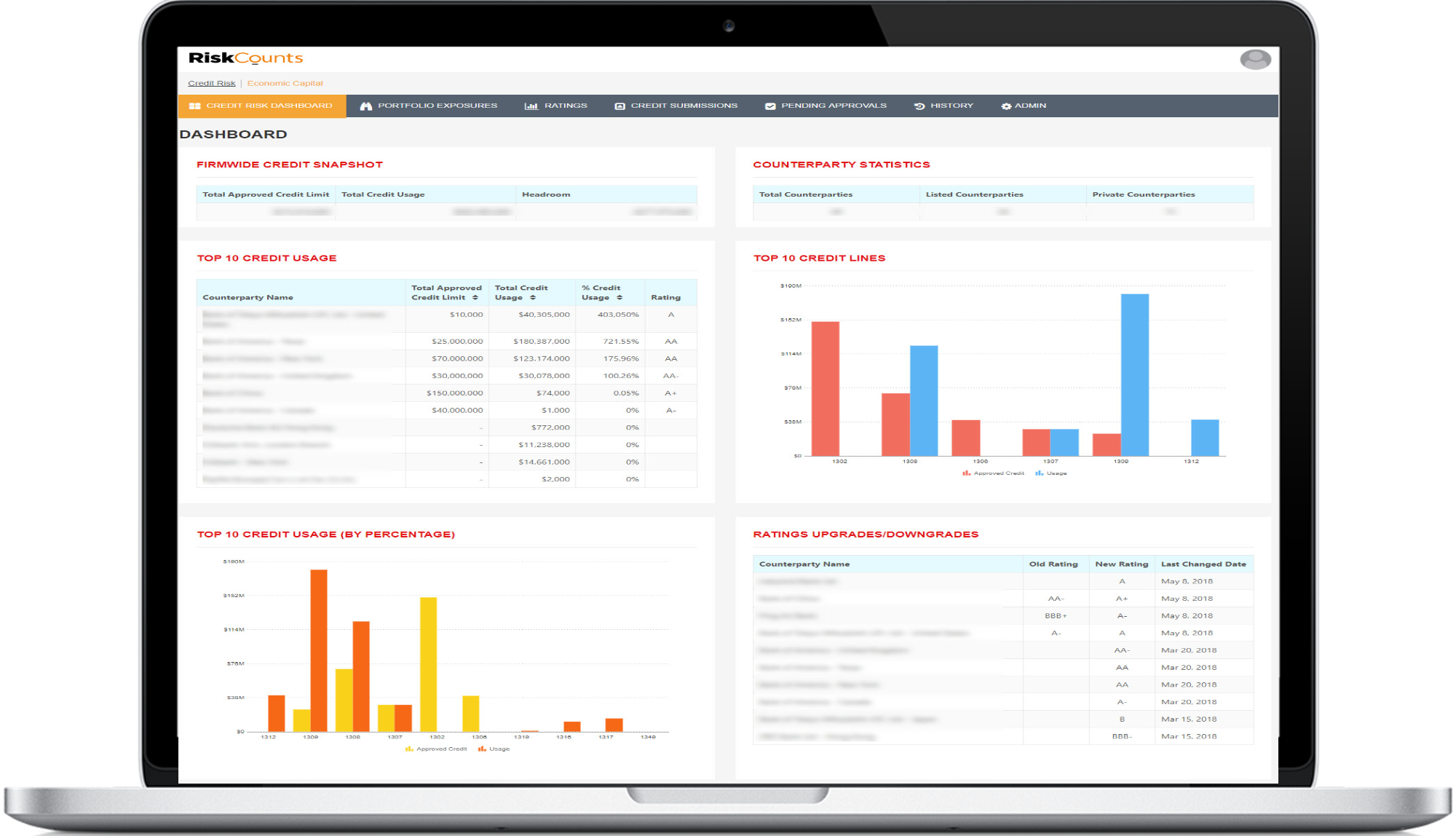

Counterparty Dashboard

-

Portfolio Aggregate views across counterparties and exposure

Portfolio Aggregate views across counterparties and exposure -

Top 10 exposures by Counterparties

Top 10 exposures by Counterparties -

Top 10 exposures by Credit Ratings

Top 10 exposures by Credit Ratings -

Ratings changes and newly rated Counterparties

Ratings changes and newly rated Counterparties -

Geographical distribution of Counterparties

Geographical distribution of Counterparties -

Economic Capital attribution for Credit, and aggregated with Market, and Operational Risk

Economic Capital attribution for Credit, and aggregated with Market, and Operational Risk

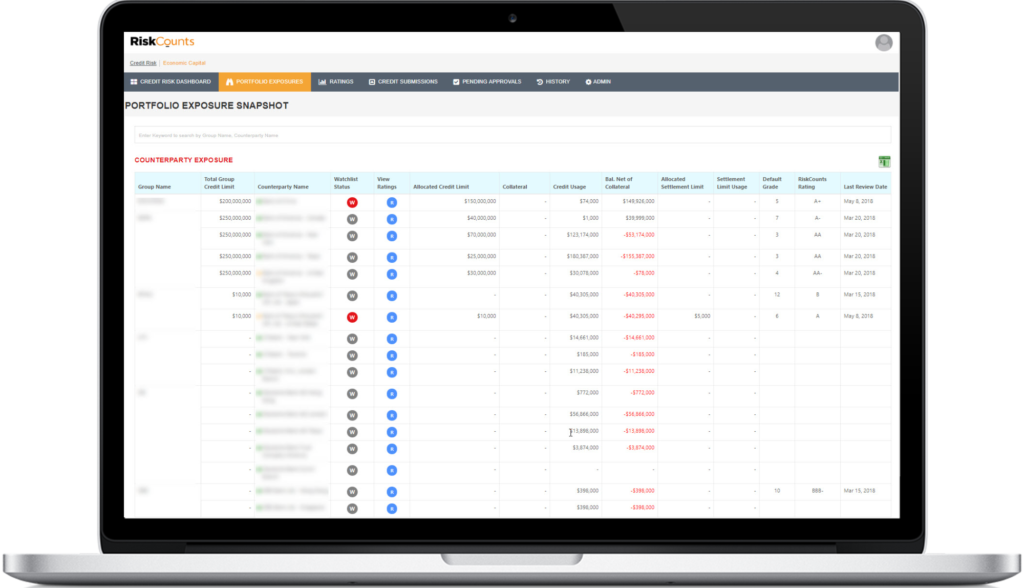

Portfolio View

-

View of exposure to all counterparties in portfolio

View of exposure to all counterparties in portfolio -

Search by counterparty name

Search by counterparty name -

View and analyze credit limits, usage, balances net of collateral

View and analyze credit limits, usage, balances net of collateral -

Add / remove counterparties from watch-list

Add / remove counterparties from watch-list -

View group level exposures, settlement limits and usage, net credit usage

View group level exposures, settlement limits and usage, net credit usage -

View rating history, and Default Grades of counterparties

View rating history, and Default Grades of counterparties

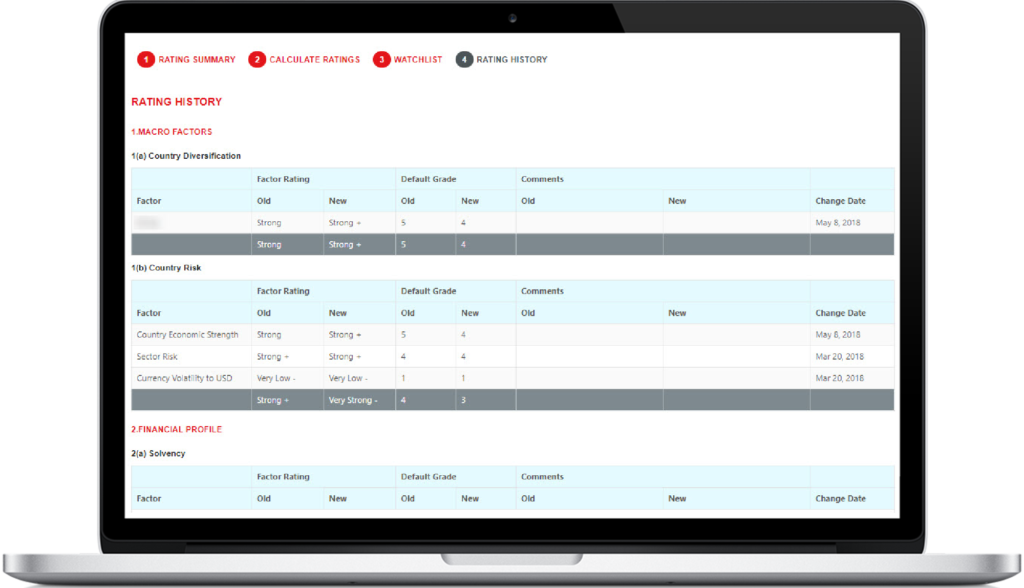

Ratings & Watchlist

-

Rate any counterparty. Ratings are based on Macro, Financial and Qualitative data. Macro and Financial data for counterparties is available through licensed feeds from a major rating agency

Rate any counterparty. Ratings are based on Macro, Financial and Qualitative data. Macro and Financial data for counterparties is available through licensed feeds from a major rating agency -

Ratings can be updated anytime, based on adoption preferences individually or via batch process that is triggered manually

Ratings can be updated anytime, based on adoption preferences individually or via batch process that is triggered manually -

A change history of ratings is maintained, as is a comparison of all inputs from prior values and ratings calculations

A change history of ratings is maintained, as is a comparison of all inputs from prior values and ratings calculations -

A Counterparty can be put on a watch-list based on rating changes and adverse news

A Counterparty can be put on a watch-list based on rating changes and adverse news

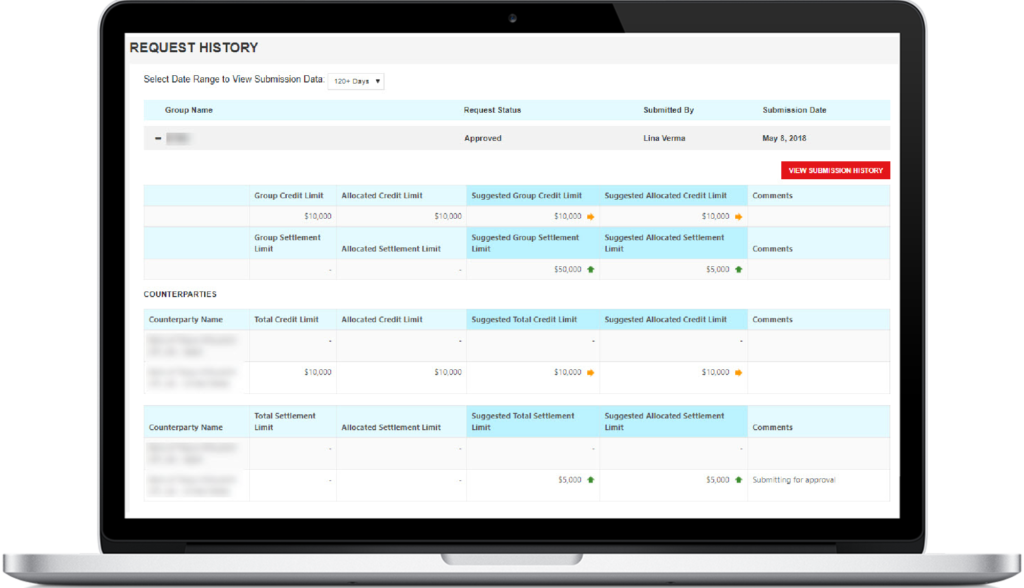

Credit & Settlement Limits

-

Complete workflow in terms of credit submission and approval

Complete workflow in terms of credit submission and approval -

Group Level Limits and Individual Counterparty limits can be set and update

Group Level Limits and Individual Counterparty limits can be set and update -

Detailed view of usage and headroom available

Detailed view of usage and headroom available -

Users can view their portfolio/counterparties, with view, edit or admin privileges

Users can view their portfolio/counterparties, with view, edit or admin privileges -

Pending Credit submission requests can be monitored. Submissions can also be withdrawn or modified

Pending Credit submission requests can be monitored. Submissions can also be withdrawn or modified -

Authorized users of the application can view approval history for the past 120 days

Authorized users of the application can view approval history for the past 120 days -

User can view date of last rating, and the Default Grade of a counterparty

User can view date of last rating, and the Default Grade of a counterparty